Homeowners envision obtaining a home Guarantee Credit line (HELOC) for many different reasons. Frequently, he or she is trying to create home improvements or money a school training. Sometimes, he could be seeking to bundle an aspiration trips or enjoys an effective back-up off cash on hand in matter-of an urgent situation. Based on your specific finances, an effective HELOC may be the proper 2nd economic step to you personally.

What is actually an excellent HELOC?

HELOCs are created to place your residence’s collateral to the office to have you. Put simply, HELOCs get will let you borrow against the latest equity on your own home without having to pay off the first home loan. Having good HELOC, youre considering a particular personal line of credit, influenced by the worth of your property and you will kept balance on the home loan. To own a simplified example a few owns a house worthy of $250,000, as well as currently owe $150,000 to their first-mortgage. It indicates, the theory is that, he has $100,000 in collateral. Yet not, the level of that guarantee they are able to borrow secured on can differ, depending on the financing system.

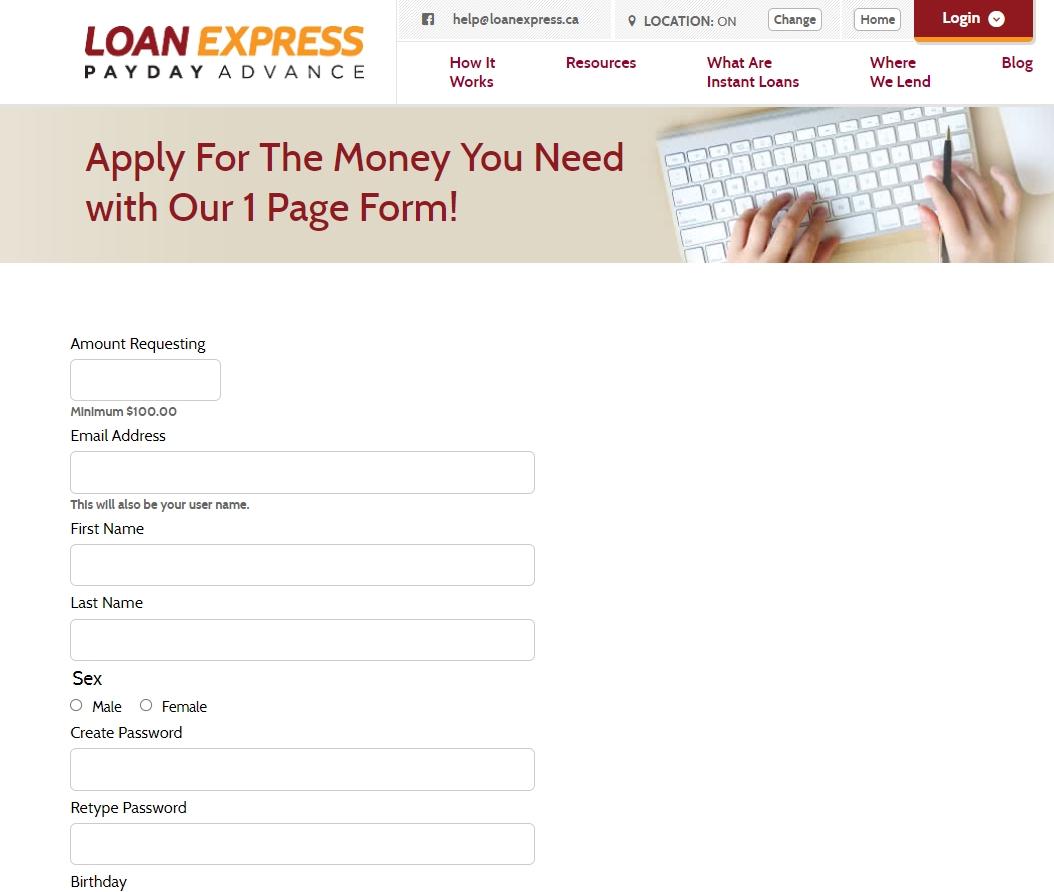

With Camden National Financial, anybody can sign up for a beneficial HELOC using our on line software system MortgageTouch. From your own mobile phone, pill otherwise pc, you could potentially securely submit every requisite documents and you may recommendations thereby applying having benefits.

Just how do HELOC payments really works?

A HELOC makes you generate checks (taken resistant to the designated personal line of credit) as required during the a designated time frame known as the Draw Period, that is generally speaking 10 years. HELOCs usually are organized that have a varying rate of interest, and thus the rate you pay isnt repaired-this may increase or down throughout the years.

From inside the Mark Period, you have to build minimal payments considering your current equilibrium (you could constantly pay far more). According to financing, the payment is according to research by the current balance, brand new appropriate interest rate, or other issues. The latest percentage is also fluctuate because these quantity changes

After the newest Draw Months, you enter the Fees Identity. During this period, brand new line can’t be used. Payments on the existing harmony will be amortized over the Payment Name so you can pay back the principal together with focus.

Which are the trick benefits associated with HELOCs?

To start with, you only pay payday loans Gulfcrest for the money you use (we.age. you will never need to pay attract on the currency you do not have fun with from your own designated line of credit). Likewise, prices may be less than personal loans or handmade cards. You could incorporate immediately after having a good HELOC and you may, if the acknowledged, you can use new line of credit repeatedly during the Draw Period. Because you always make money, those funds end up being available for you to utilize once more for the Mark Months. Payment quantity is flexible-their fee is just as lower because focus-just payment, you have the ability to pay down the loan during the area or perhaps in full any moment. Make certain, not, that you understand what would bring about very early closeout fees for your HELOC for folks who pay back what you owe very early.

What you can disadvantages ought i believe?

Given that interest rates usually are susceptible to transform, you may possibly have a higher fee when the interest levels go up. In case the concept of an adjustable rate of interest enables you to scared, you can also imagine a predetermined-rates loan, such as for instance a property Collateral Mortgage, that’s quite not the same as an effective HELOC.

In addition, when you use a great HELOC so you can consolidate high rate of interest playing cards, abuse is required to end a pattern out of overspending. And also make minimum money during the mark period may not pay back your line equilibrium. Remember this for the Mark Several months, and you will know that the fee can get improve somewhat when it transforms to your Repayment Months. Be sure to to consider the paying activities and you will potential for sustained financial obligation.

Interested in much more?

All of our knowledgeable financing originators is actually here to help you function with your best choices for HELOCs, HELOANs and you may refinancing their financial. We’re here for your requirements 24/eight from the 800-860-8821.